Managing Transactions Across Multiple Brokerages? Here's How TCs Keep It Straight

You just got a new contract from Agent B. But wait! Agent B moved from Keller Williams to Compass last month. That means the compliance packet changed, the disclosure timeline is different, and you need to remember which brokerage-specific forms to include. Meanwhile, Agent A at your indie brokerage needs things done completely differently. And Agent C? Their brokerage just added three new mandatory disclosures you haven't memorized yet.

Welcome to the reality of running transactions across multiple brokerages. Most TC advice out there assumes you're working within one brokerage, following one set of rules. But if you're like most independent TCs, you're juggling agents at three, four, maybe five different brokerages (each with their own compliance requirements stacked on top of whatever the state already requires).

The mental gymnastics of keeping it all straight is exhausting. And the stakes are high: forget one brokerage-specific form, and suddenly you look unprofessional. Or worse, you've created a compliance issue that lands on the agent's desk right before closing.

Why Brokerage Requirements Are So Hard to Track

Here's what nobody tells you when you start taking on agents from multiple brokerages: state requirements are just the baseline. Every brokerage layers their own stuff on top. One requires a proprietary wire fraud warning. Another mandates their branded buyer advisory. A third has a 48-hour disclosure delivery policy that's stricter than the state's requirement. And the franchise brokerage down the street? They've got a whole packet of forms that corporate requires on every single file.

These requirements change, too. Sometimes you get an email about it. Sometimes you find out when a broker calls asking why the form is missing. Not exactly ideal.

The problem is that most TCs try to manage this through memory and spreadsheets. You've got a tab for each brokerage, maybe color-coded by agent. You check the tab when you start a new transaction. Except when you're busy and forget to check. Or when you're working late and grab the wrong template. Or when you haven't worked with that agent in three months and can't remember if their brokerage updated their requirements.

This isn't sustainable. And it doesn't scale.

Building a System That Remembers for You

The TCs who handle multiple brokerages without losing their minds all do something similar: they build systems with layers.

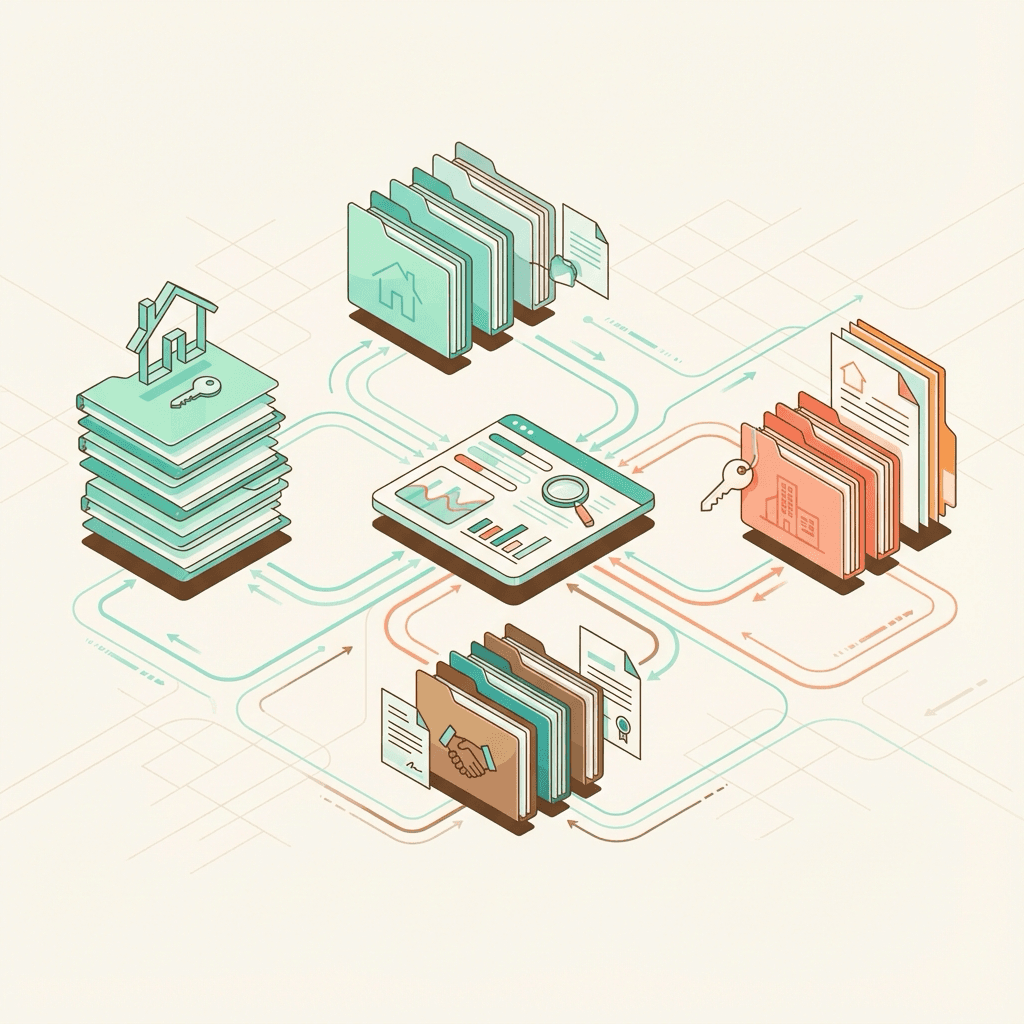

Think of it like this. You have a baseline—the state requirements that apply to every transaction. That's your foundation. On top of that, you layer brokerage-specific requirements that automatically apply based on which brokerage the agent belongs to.

So when Agent B sends you a contract, you're not mentally running through a checklist of "okay, Compass requires X, Y, and Z." The system already knows Agent B is at Compass. The Compass requirements are already there.

This approach has a few benefits. First, you're not relying on memory. Memory fails. Systems don't. Second, when a brokerage updates their requirements, you update it once in your system—and it applies to every future transaction with agents at that brokerage. Third, onboarding a new agent becomes trivial. You just need to know their brokerage, and the requirements auto-populate.

The difference is dramatic. Transaction setup goes from 20 minutes of mental recall and double-checking to 2 minutes of confirmation. You catch things you would have missed. And you can take on more agents without proportionally increasing your workload.

What This Looks Like in Practice

Let's say you're a TC working with agents at three brokerages: a Keller Williams franchise, a Compass office, and an independent boutique brokerage.

A new contract comes in from your Compass agent. You upload it, and immediately your system shows you the California state requirements—TDS, SPQ, NHD, the usual. But it also shows the Compass-specific items: their branded buyer advisory, their disclosure timing requirements, their specific wire fraud warning.

You didn't have to remember any of that. It's just there.

Now imagine your KW agent sends a contract the same day. Different set of brokerage requirements auto-populate. Their franchise disclosure packet. Their specific compliance timeline. Their required acknowledgment forms.

Two transactions, two completely different brokerage requirement sets, zero mental effort switching between them.

That's the power of building a layered system.

How Ava Handles Multi-Brokerage Workflows

This is exactly why we built Ava to learn from your transactions. When you work with an agent, Ava remembers their brokerage. She learns what's required. And the next time that agent sends you a deal, she applies the right requirements automatically.

You can set up brokerage-specific checklists once, and Ava uses them forever. When requirements change, you edit the template—and it updates everywhere. She's essentially doing the "remember which agent needs what" work for you, so you can focus on actually managing the transactions instead of managing spreadsheets about transactions.

The Bottom Line

Stop trying to remember every brokerage's requirements. Build a system that knows them for you. Whether that's a well-structured template system or an AI that learns your process, the goal is the same: get the remembering out of your head and into something that won't forget.